Garuda Indonesia's domestic market share has sunk to just 5% in June. Indonesia's beleaguered flag carrier has lost market share to a steady flow of new low-cost startups and an increasingly assertive Lion Group. These two non-COVID-related trends help explain why Garuda Indonesia is having such a tough time in the contemporary Indonesia aviation market.

The rise of low-cost carriers in Indonesia's domestic airline market

Indonesia is usually the world's fifth-largest domestic aviation market. The market has now recovered to around 80% of pre-pandemic capacity. Aviation analyst Brendan Sobie told a recent IBS online discussion that the Indonesian domestic market shares some similarities with other airline markets but also has some unusual quirks.

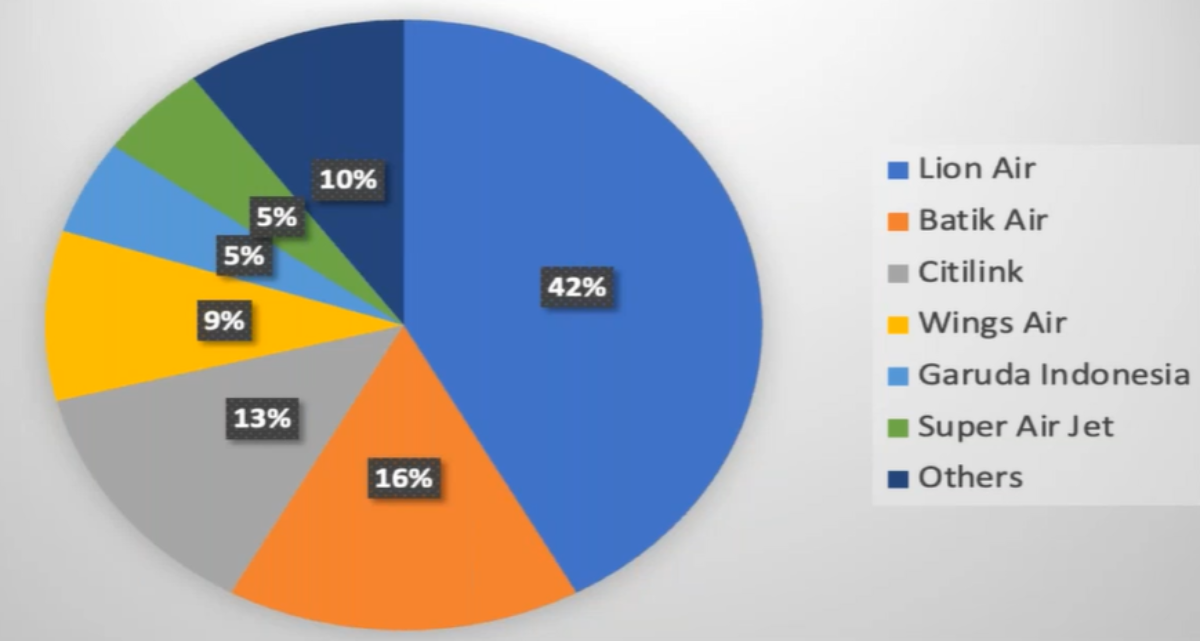

One of the big Indonesian trends is the rise of the low-cost carriers. They've been around in the Indonesian domestic market since the turn of the century, but since the pandemic, the combined domestic market share of low-cost airlines is now above 70%. Lion Air, a low-cost carrier, has a 42% share of Indonesia's domestic aviation market this month. Other low-cost carriers with sizeable market shares include Wings Air (9%), Indonesia AirAsia (5%), recently launched Super Air Jet (5%), and Garuda subsidiary Citilink (13%). Lion Group airlines have a 70% domestic market share, while the once-mighty Garuda Group has an 18% domestic market share.

"What we've seen with Garuda is that they have a lot more capacity and a lot more flights with Citilink than with Garuda. This has been happening throughout the pandemic, and CitiLink has become a much larger airline compared to Garuda. It will stay that way in Garuda's post-restructuring phase. They will focus more on the low-cost carrier because that's where the growth potential is," said Mr Sobie.

Is the Lion Group's market dominance here to stay?

Once Garuda's restructuring is done and dusted, Garuda Indonesia will end up with around 70 planes (around a 50% fleet reduction), while Citilink will keep its 50 planes. The other big Indonesian domestic airline industry trend is the rise of the Lion Air Group. The Indonesian stable includes Lion Air, hybrid Batik Air, Wings Air, and Super Air Jet.

"They've always been targeting higher market share, and I think before the pandemic, they were kind of targeting 60%. But now they're targeting closer to 70% and have achieved at least recently 70%," said Brendan Sobie. "This 70% figure might be hard to maintain as other airlines bring back capacity and as we see new airlines continuing to come into the market on the best trunk routes. But at least for the moment, 70% of capacity is being held by these four airlines in the Lion family."

From a passenger's perspective, any airline group having a 70% market share isn't usually a good thing. Mr Sobie thinks the Lion Group will face some decent competition from a restructured Garuda Group and other new and emerging players. Plenty of unserved or underserved routes remain, particularly point-to-point routes that avoid a change of plane in Jakarta. He sees room for smaller players like Indonesia AirAsia, which until now, has largely focused on international routes, but that's starting to change.

Indonesia's airlines handled over 100 million domestic passengers annually before the pandemic. The expectation remains that Indonesia will be the world's fourth-largest domestic airline market by 2030. There's plenty of growth remaining and plenty of scope for various airlines, including the Garuda Group, to take it up to the Lion Group powerhouse between now and then.